Latest Disclosure UK data: higher R&D spend, greater transparency and more partnership with the NHS

Each year the ABPI publishes information via the Disclosure UK database which shows payments and benefits-in-kind from pharmaceutical companies to NHS organisations and medical professionals, in line with the ABPI’s Code of Practice. The 2023 data continues to show positive trends, says the ABPI’s Medical Director Dr Amit Aggarwal.

In an era of ever-increasing healthcare needs, where one in two of us will get cancer [1], one in four of us live with two or more health conditions [2], and nearly three million people are not working due to long-term sickness [3], pressures on the NHS have never been greater.

Engagement between the NHS and industry is essential to delivering the improved care and outcomes we all want to see. This interaction brings a multitude of benefits – from improving how treatments are delivered, to ensuring access to treatment is fair and equitable, accelerating adoption of innovation, and contributing to a more sustainable healthcare system.

To ensure patient confidence and trust, these interactions must also be transparent. Disclosure UK plays an important role in the UK system of self-regulation, providing a publicly accessible platform detailing payments and benefits-in-kind to healthcare professionals and organisations from pharmaceutical companies.

The latest upload of 2023 data to Disclosure UK [4], published on 28 June, continues to show the positive trends of previous years and there are three areas to highlight.

Investment in R&D

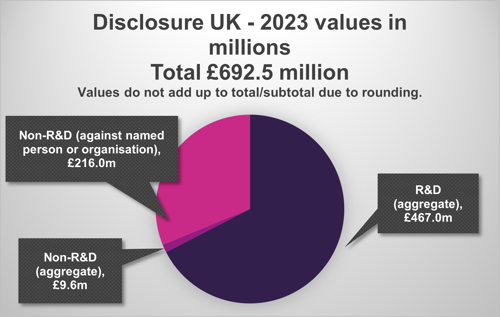

The latest Disclosure UK data shows another increase in R&D spend, with £467.0 million invested in R&D collaborations in 2023, up from £440.6 million in 2022, and £405.1 million in 2021. [5]

There is a lot of variation between companies, with some reporting less R&D spend than previously and others more, but overall, this trend is positive.

Transparency in non-R&D data

In 2023, the estimated percentage of healthcare professionals named on Disclosure UK is the highest level ever reported at 80.8%. This compares to 78.8% in 2022 and 72.6% in 2021. [6]

We want to see this number go even higher, and generally support the potential introduction of legislation by the next government to make disclosure mandatory.

In the absence of mandatory disclosure, the growing percentage of named healthcare professionals demonstrates that healthcare professionals and companies increasingly understand and proactively opt in to the need for transparency.

The proportion of non-R&D spend disclosed against a named individual or healthcare organisation also increased, up to 96% in 2023 from 95% in 2022 and 94% in 2021.

The total value of non-R&D spend was £225.5 million, up from £201.6 million in 2022, and £152.0m in 2021 [7]. However, there is a lot of variation between companies, with some reporting less non-R&D spend than last year and others more. [8]

The ABPI requires our members to adhere to the ABPI Code of Practice which includes mandatory disclosure via Disclosure UK. However, the actual number of companies abiding by the ABPI Code extends far beyond those within ABPI membership. Signing up to the Code signals a companies’ commitment to the highest standards above and beyond the law, so we continue to encourage the minority of companies not signed up to do so.

Professional bodies such as the Academy of Medical Royal Colleges (AoMRC) and NHS England also back transparency through Disclosure UK and encourage all healthcare professionals to agree be part of it. AoMRC have published a new statement encouraging their members to continue to uphold high standards; NHS England references Disclosure UK in its Conflict of Interest guidance.

Partnership working

That brings me to the final highlight from this year – the data on collaborative working. In this form of partnership, NHS organisations and companies pool skills and resources with a resultant benefit to patients or the NHS. While only a part of the wider non-R&D work captured on Disclosure UK, such projects have seen some large increases in recent years, with £24.9 million invested by companies in 2023, up from £15.5 million in 2022 and £7.1 million in 2021. [9]

This is great news as these types of projects can achieve great things for patients and the NHS. You can see examples of partnership projects in action here.

The latest guidance from the ABPI and the NHS Confederation, Accelerating transformation: How to develop effective NHS-industry partnerships, is also essential reading for companies or NHS organisations considering entering into a partnership, as it will help ensure that every partnership is set up for success.

Other highlights

The total disclosed value, including R&D and non-R&D, increased by 7.8% to £692.5 million in 2023, from £642.1 million in 2022, and £557.2 in 2021.

A total of 143 pharmaceutical companies disclosed 2023 data via Disclosure UK, down slightly from the 145 from last year, but still up from 139 companies in 2021. [10]

We will continue to monitor the trends in spend from pharmaceutical companies to healthcare professionals and organisations for both R&D and non-R&D activities. We encourage all those in healthcare and industry to continue to develop the ambition and scale of their interactions and collaborations to benefit patients and the NHS.

References

[1] Cancer Research UK, ‘Lifetime risk of cancer’, 2020.

[2] NIHR blog, ‘Multiple long-term conditions (multimorbidity): making sense of the evidence’, 2021.

[3] Statista, ‘Number of economically inactive people due to long-term sickness in the United Kingdom’, May 1993 to April 2024.

[4] Disclosure UK is the public, searchable database publishing ‘transfers of value’ (payments and benefits in kind) from pharmaceutical companies to UK healthcare professionals and organisations. It is part of pharmaceutical industry transparency requirements across Europe. You can find the Disclosure UK database and other resources at www.disclosureuk.org.uk.

Transfers of value disclosed via Disclosure UK include both direct or indirect payments, and benefits-in-kind, for example the value of a train ticket or accommodation.

Disclosure UK also hosts two ‘gateways’ taking visitors to disclosure information about industry’s work with patient organisations and certain members of the public. Both disclosure gateways have been updated with the relevant links for 2023.

[5] Values for research and development (R&D) are always published in aggregate and include transfers of value to healthcare professionals or healthcare organisations related to the planning or conduct of:

- non-clinical studies (as defined in the OECD Principles of Good Laboratory Practice)

- clinical trials (as defined in Directive 2001/20/EC)

- non-interventional studies that are prospective in nature and involve the collection of data from, or on behalf of, individual or groups of healthcare professionals specifically for the study

- costs that are subsidiary to these activities are also included.

Disclosure UK is part of a European-wide transparency requirement for the pharmaceutical industry administered by EFPIA. European-level requirements are that R&D is disclosed in aggregate. There are various challenges to breaking down this data further, including that many R&D payments are blinded, issues with confidentiality agreements, challenges for companies reporting differently across multiple countries, and adding more red tape to R&D activities at a challenging time for UK clinical trials.

[6] The percentage of named individuals is related to the lawful basis a company uses to process healthcare professionals’ data under the GDPR. For example, if a company is using ‘Consent’ as the lawful basis, but permission is withheld by the HCP, the value can only be published in aggregate (not against a named person) on Disclosure UK.

The data show that a growing number of pharmaceutical companies are moving to the GDPR’s lawful basis of ‘Legitimate Interests’, instead of Consent, to manage their healthcare professional disclosure commitments. For information on what this means, see our ‘What is Legitimate Interests?’ factsheet available from the Disclosure UK resources.

The percentage rate of named healthcare professionals can only be estimated. Many healthcare professionals work with multiple companies so the same individual could appear in multiple companies’ aggregate data. A formula is applied taking into account an estimate of duplicates to give the estimated overall named HCP rate. Our data analysts use the same formula each year for consistency.

[7] Values for non-R&D collaborations are broken-down and published against individually named healthcare professionals where data protection law allows, or healthcare organisations. These activities include:

- Registration fees – e.g., a company paying for an HCP to attend a medical conference for education and training.

- Sponsorship agreements with HCOs – e.g., a company may fund an independent organisation to run a training seminar.

- Travel and accommodation – e.g., paying for the accommodation or rail fares for an HCP to attend a conference.

- Donations and grants to HCOs – e.g., buying equipment for HCOs, such as medical equipment, books, or products which support disaster relief.

- Contracted services: Fees – e.g., paying HCPs for their time to sit on advisory boards and help with the development of medicines.

- Contracted services: Related expenses – e.g., travel and accommodation requirements to support an HCP to deliver the work they were contracted to do for a pharmaceutical company.

- Collaborative working – which refers to pharmaceutical companies working with other organisations to deliver initiatives which either enhance patient care or are for the benefit of patients or alternatively benefit the NHS and, as a minimum, maintain patient care.

- More information in How we work with HCPs and How we work with HCOs.

[8] Some 2022 and 2021 activities were impacted by restrictions during and in the aftermath of the pandemic which means the values may not be comparable to those which took place in a non-pandemic year.

[9] The 2023 HCP/HCO data can be broken down as illustrated in the following chart:

Note: Figures do not add up due to rounding.

|

|

Presenting results based on 2023 data as of 19 June 2024 to allow time for analysis. Numbers can be updated over time. 2022 data as of 22 June 2023; 2021 data as of 23 June 2022. |

|||

|

Total categories |

2021 value |

2022 value |

2023 value |

|

|

What was the total transfer of value disclosed? |

£557.2 million |

£642.1 million |

£692.5 million |

|

|

How much did the industry spend on R&D collaborations with HCPs and HCOs? |

£405.1 million |

£440.6 million |

£467.0 million |

|

|

What percentage change was there in R&D spend vs. the previous year? |

+ 16.1% |

+8.8% |

+6.0% |

|

|

How much was spent on HCPs and HCOs for non-R&D collaborations? |

£152.0 million |

£201.6 million |

£225.5 million |

|

|

How much of the non-R&D value was against a named person or organisation? |

£142.5 million |

£191.7 million |

£216.0 million |

|

|

What percentage of the non-R&D value is disclosed against a named person or organisation? |

93.8% |

95.1% |

95.8% |

|

|

Estimated percentage of named HCPs in the non-R&D spend |

72.6% |

78.8% |

80.8% |

|

|

Amount spent on the following for non-R&D collaborations: |

|

|

||

|

· Registration fees |

£3.0 million |

£3.1 million |

£3.3 million |

|

|

· Sponsorship agreements with HCOs/3rd parties |

£32.0 million |

£39.7 million |

£46.5 million |

|

|

· Travel and accommodation |

£0.4 million |

£5.3 million |

£8.3 million |

|

|

· Donations and grants to HCOs |

£44.0 million |

£47.2 million |

£51.3 million |

|

|

· Contracted services - Fees |

£65.1 million |

£88.0 million |

£86.4 million |

|

|

· Contracted services - Related expenses |

£0.4 million |

£2.7 million |

£4.7million |

|

|

· Collaborative working |

£7.1 million |

£15.5 million |

£24.9 million |

|

|

How many pharmaceutical companies disclosed data? |

139 |

145 |

143 |

|

[10] The number of disclosing companies per year can fluctuate due to mergers or acquisitions, starting or ending relevant UK activity, or new companies formally complying with the ABPI Code of Practice.

Last modified: 02 October 2024

Last reviewed: 02 October 2024